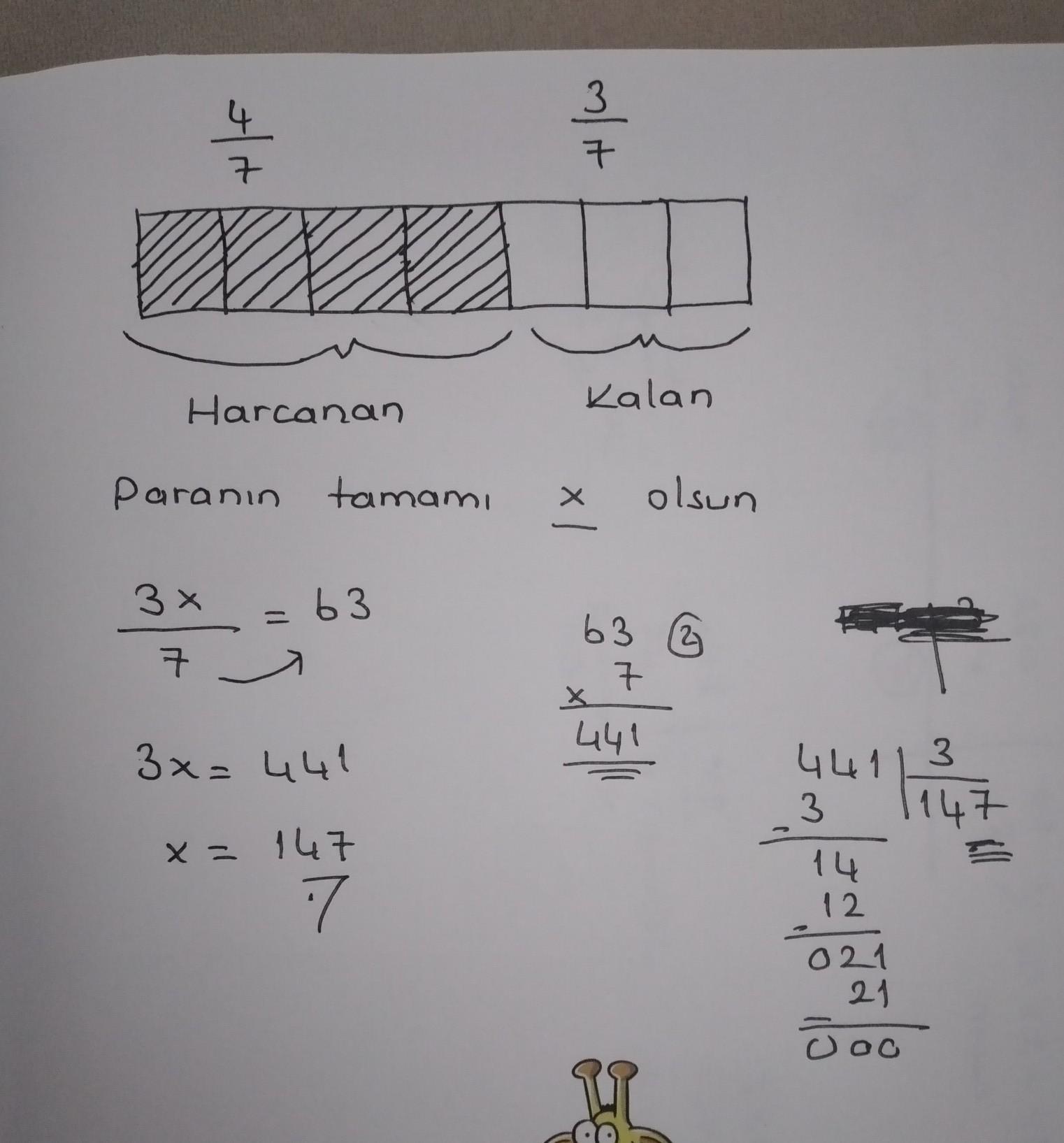

Cevap:

Particulary, in recent years obesity rates have been incresing around the world. This position brought along

a lot of problems. On one hand obesity impairs health of individual, and on the other hand this gives rise to

serious costs because it generates health issues. Because of these reasons, a number of governments have taken action. In order to fight with obesity problem, many government policies have been implemented so

far by the governments around the world. One of these policies is obesity tax. This tax has been enforced

in recent years, especially in OECD countries. On the other side, obesity tax is being disputed by public

opinions of some OECD countries in these days. In this article, informations about OECD countries like

Mexico, Hungary, Denmark and France which have been implementing obesity taxes in recent years, will be

assessed. At the same time, in this article, appreciations relating to OECD countries like Turkey and Australia

which are arguing obesity taxes in these days, will be given a place as well.

Obesity is a problem in both developed and developing countries, especially in recent years.

started to become. On the one hand, the rapid increase in the use of ready-made food products

On the other hand, the increase in the consumption of food products with low nutritional value but high in calories,

It has increased people's weight gain in a short time, and accordingly, many diseases have been caused.

has emerged. However, the resources of the countries are gradually decreasing.

to meet the health care costs that may occur due to obesity.

makes it difficult. In addition, this problem is the guarantee of both adults and future generations.

The siege of children leads governments to take measures in this regard. Of course this

It should be mentioned that the measures have many dimensions.

On the one hand, people's orientation to an active life, on the other hand, unhealthy products

a number of issues such as reducing their consumption or increasing the consumption of healthy products.

state intervention tools may come to the fore. One of these intervention tools is

tax applications that focus on solving the obesity problem. Applications in this direction

It has been brought to the agenda and put into effect by many countries, especially in recent years.

In particular, the OECD, which includes many countries from different levels of development,

It shares many data regarding the obesity problem in affiliated countries and country practices

It provides some information about In this context, in the OECD and in recent years

enacting or bringing up the obesity taxes related to the solution of the obesity problem

Talking about the practices and approaches of the countries is the main dynamic of this study.

forms. Within the scope of this information, in the first part of the study, it is aimed to solve the obesity problem.

In this article, tax applications for tax purposes are explained in terms of fiscal literature.

Açıklama:

Umarım Yardımcı Olabilmişimdir